Your Partners in Tax Excellence

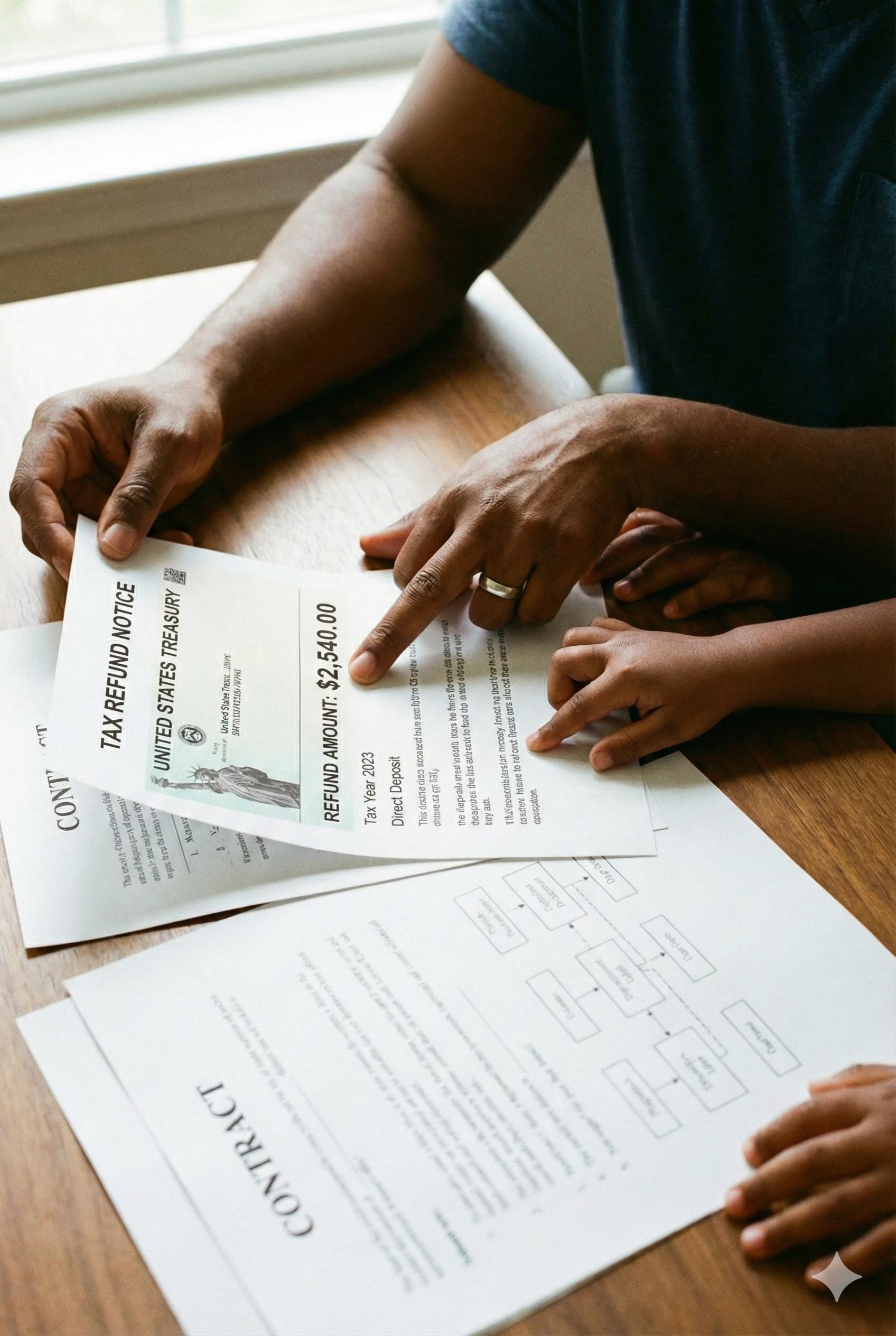

A boutique practice dedicated to providing personalized tax preparation and financial planning. We believe in building genuine relationships—taking the time to understand your unique situation.

Direct access to your tax preparer. No call centers, no automated systems—just genuine, one-on-one service tailored to you. We take the time to understand your story.

As a small practice, we're nimble and responsive. You won't get lost in the shuffle—your questions and concerns are our priority, year-round.

We're a growing practice committed to earning your trust. Your success helps us grow, creating a true partnership built on results, integrity, and mutual respect.

Three essential services designed to give you complete peace of mind.

Individual Tax Prep

We handle everything from simple W-2s to complex investment income. Our thorough approach ensures you don't miss any deductions.

Learn MoreTax Planning

Proactive tax planning throughout the year helps you make informed financial decisions and optimize your contributions.

Learn MoreAudit Support

We stand by our clients if questions arise, guiding you through the process with confidence and representing your interests.

Learn MoreQuestions? We have answers.

24h

Response Time

100%

Dedicated

365

Days Support

We're a small, boutique practice focused on building genuine relationships with our clients. You'll work directly with your tax preparer—no call centers, no getting lost in the system. We're committed to earning your trust through quality service.

For most individual returns, you'll need income statements (W-2s, 1099s), expense records, and documentation for deductions (mortgage interest, charitable donations, etc.). We'll provide you with a personalized checklist based on your situation during our initial consultation.

Most individual returns are completed within 3-5 business days after we receive all necessary documents. Complex returns involving business income, multiple states, or international matters may take 7-10 business days. We'll give you a realistic timeline upfront.

Absolutely. Tax season doesn't define our relationship with clients. We're available throughout the year for tax planning, answering IRS notices, and helping you make tax-smart financial decisions. You're not just a seasonal client—you're part of our community.

Our fees are based on the complexity of your tax situation, not a one-size-fits-all rate. Individual returns typically start at $200, small business returns at $500. We'll discuss pricing transparently during our consultation—no hidden fees, no surprises.

Yes. While we work diligently to prevent audits through accurate, compliant filing, we stand by our clients if questions arise. We'll help you respond to IRS notices and can represent you in audit proceedings. Our goal is to give you peace of mind.

Still have questions?

We're here to help. Give us a call.

Precision. Integrity. Partnership.

Defined by a commitment to excellence, we provide tax strategies that are as unique as your financial journey.

Let's start the conversation.

Let's Work Together

Book a free consultation and let's discuss how we can help you navigate your tax situation with clarity and confidence.